Tokenized Securitization

July 17, 2019

Tokenizing Securitization

On the 15th of September 2008, Lehman Brothers filed for the largest bankruptcy in the history with around $1200 billion in debt. In the movie “The Big Short”, Ryan Gosling explains how CDOs (Collateralized Debt Obligations) are constructed. He uses Jenga to explain securitization, showing how less risky AAA-rated securities can default, when they are composed of riskier BBB and CCC rated securities.

What is Securitization

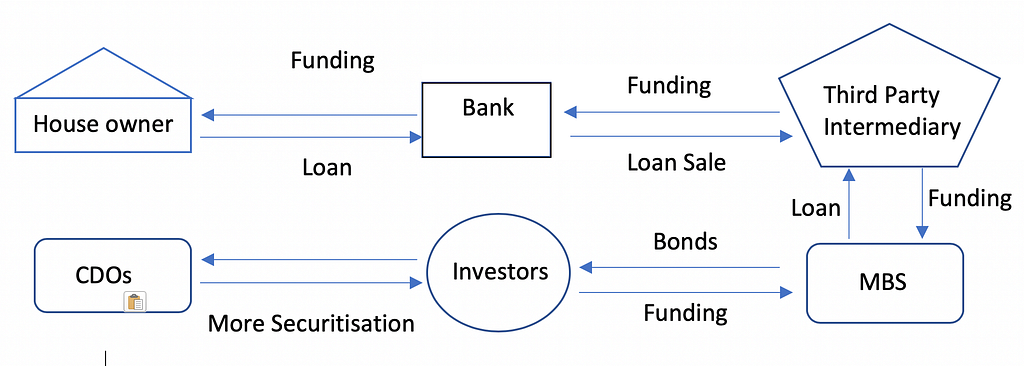

Back in the 1970’s it was a common practice that banks (Lenders) would keep your mortgage on its balance sheet till you (Borrowers) repay the loan. Securitization gave a new pathway to offload/sell the credit risk of an unsetted mortgage to a third party (SPV). This third party can be a private organisation, a government agency, or a mutual fund. This third party will pool asset backed securities into a diversified portfolio of AAA (bonds), BBB, and CCC (equity) tranches. These new securities can be traded in the secondary market and be bought by investors living in any part of the world.

In this way, lenders offload the credit risk, borrowers convert their highly illiquid asset into a liquid one, and investors get the benefit of investing in a greater range of assets. A CDO can be constructed when these investors again package their securities in a basket of funds and sell/trade them further in the market.

But we have learned from the financial crisis that how securitization is conducted can also be extremely harmful to the financial markets and the wider public without appropriate diligence and oversight.

Added to that, securitization can be complex, time consuming, and costly. There isnt complete transparency between the parties (borrowers, lenders, SPVs, investors, regulators, auditors) involved in the entire securitization chain. This impacts auditing and ratings of underlying assets.

Tokenization to the Rescue

Tokenization refers to converting an asset to a digital form represented by a token, but how can tokenization solve the problems with securitization?

- Tokenization allows for increased fractional ownership when compared to fiat currency. This broadens the investor portfolio, increasing the liquidity of the asset.

- The business rules and constraints can be encoded in the CorDapp contracts, helping automate processes like dividend distributions, and tracking the underlying latest asset price. This increases the speed of settlement and transfer of ownership.

- KYC, compliance, and regulatory rules can be encoded in CorDapp contracts, streamlining the entire securitization process.

Using Corda to tokenize your asset

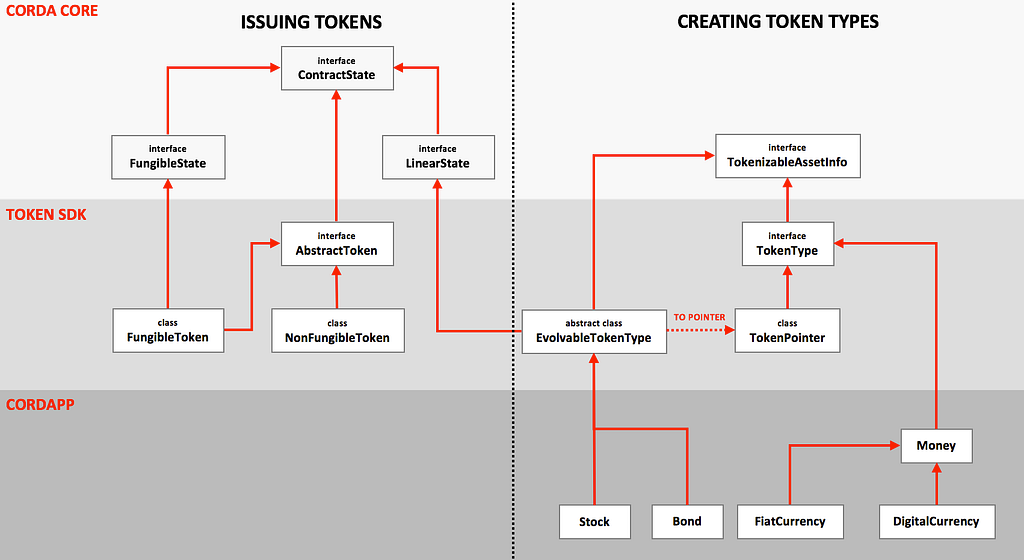

In Corda a token represents an agreement between an issuer and a holder. There are two types of tokens which are supported by the tokens SDK:

- Depository receipts or asset backed tokens.

- Ledger native assets which are issued directly on to the ledger by parties participating on the ledger.

Furthermore, tokens come in fungible and non-fungible varieties.

- Fungible tokens can be split and merge, for example: money, stocks, and bonds.

- Non-fungible tokens cannot be split and merged, for example: title deeds and loans.

With the concepts defined above, here’s a proposal for a series of types which should be able to fulfil some use-cases involving agreements, tokens, assets (liabilities), etc.

Lets try to create, issue, move, and redeem a RealEstate non-fungible token. Real estate can be represented by an evolvable token type. EvolvableTokenTypes are state objects because the expectation is that they will evolve over time.

1. Create an evolvable real estate token type

To create a real estate type, call the predefined CreateEvolvable flow:

https://medium.com/media/604bde146b54ff3dbc1a45d0b67c119f/href

2. Issue Token

To issue a token, call the predefined IssueTokens flow:

https://medium.com/media/3868331e31165f047cc2dd644b502891/href

3. Move Token

To move a token, call the predefined MoveNonFungibleTokens flow:

https://medium.com/media/563c92750043c67876e02952959e8030/href

4. Redeem Token

To redeem a token, call the predefined RedeemNonFungibleTokens flow:

https://medium.com/media/b8848687f3b465c100fd05a35e60eaa5/href

Token templates in are available in Java and Kotlin on github page.

Enabling securitization via tokenization provides tangible improvements for token issuers, borrowers, lenders , regulators , auditors and investors. Using tokens can add efficiency to the securitization process, increase liquidity, add more transparency, assist real time settlement, transparent auditing and compliance.

Corda Token SDK is available at:

Thanks for reading — Sneha Damle, Developer Evangelist (R3)

Tokenized Securitization was originally published in Corda on Medium, where people are continuing the conversation by highlighting and responding to this story.